A 400-Year-Old Bond Still Pays Interest: A Remarkable Financial Legacy

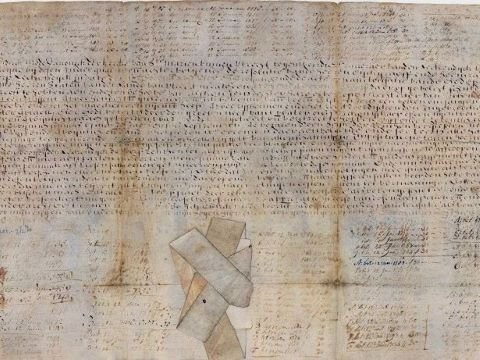

A 400-Year-Old Bond with No Expiry: Unlike traditional bonds that mature within a fixed time frame, perpetual bonds have no maturity date and pay interest indefinitely. A fascinating example is a bond issued 400 years ago by a Dutch water authority, Hoogheemraadschap Lekdijk Bovendams. On December 10, 1624, this bond was sold for 1,200 Carolus guilders to fund dike repairs following severe damage earlier that year. The bond promised to pay 2.5% annual interest in perpetuity.

World’s oldest bond celebrates 400 years with a €300 payout https://t.co/IGb4Cqq0wR pic.twitter.com/UL9FfDBKcU

— DutchNews.NL (@DutchNewsNL) December 11, 2024

On Tuesday, the current bondholder, the New York Stock Exchange (NYSE), received its latest interest payment in a ceremony attended by the Financial Times. This payment highlights the enduring nature of this unique financial instrument.

The Bond’s Journey Through History

Over the centuries, this bond has survived wars, natural disasters, and significant economic changes. By the 20th century, a Dutch-American banker acquired the bond at auction and later donated it to the NYSE in 1938, symbolizing goodwill and recognizing New York City’s Dutch heritage.

Although the original issuer no longer exists, its modern successor, Hoogheemraadschap De Stichtse Rijnlanden, continues to honor the bond. With the transition from guilders to euros, the bond now pays an annual interest of €13.61.

A Ceremony and a Historic Payment

For nearly two decades, the NYSE had not collected any interest on the bond. During the recent payment ceremony in the Netherlands, the NYSE received £299.42, representing interest accrued since 2004. The funds were subsequently donated to a local dike museum, paying homage to the bond’s origins.

Perpetual Bonds in a Modern Context

While perpetual bonds like this are rare, their existence underscores the unique ways financial instruments can endure through time. Today, global financial markets are inundated with various forms of debt, including sovereign, municipal, and corporate bonds. In contrast to the stability of this Dutch bond, concerns over the U.S. debt trajectory and its sustainability remain at the forefront of economic discussions.

This extraordinary bond exemplifies how financial obligations, when honored, can span generations, serving as a testament to historical resilience and fiscal integrity.

See Also:

OpenAI Whistleblower, Suchir Balaji, Found Dead in US

How Much Prize Money Did Gukesh Win

86 Indians Killed or Attacked Abroad in 2023

Police Summon Wife of Atul Subhash in Suicide Investigation

——————————————————————————-

It would mean the world to us if you follow us on Twitter, Instagram and Facebook. At Newscazt, we strive to bring you the latest news and stories from India, World, Business, Sports, Entertainment and more. Our team of experienced journalists and writers are committed to delivering accurate and unbiased news and analysis.