Budget 2025 to Usher in Major Income Tax Reforms

India is on the cusp of a significant transformation in its tax landscape as the Union Budget 2025-26 promises a slew of reforms to simplify the Income Tax Act, streamline tax filing, and enhance compliance across the board. According to Finance Ministry sources, these upcoming reforms aim to alleviate the compliance burden, expand the tax base, and encourage a more business-friendly environment in India.

Union Budget 2025: Reforming the Income Tax System

Scheduled for presentation in February 2025, the Union Budget is expected to address longstanding complexities within the Indian tax system. Sources indicate that Finance Minister Nirmala Sitharaman and Prime Minister Narendra Modi are keen on transforming tax filing into a straightforward and accessible process for all citizens. These changes follow years of gradual adjustments that have aimed to make the tax system more efficient and less burdensome for taxpayers.

Reducing Compliance Burden: A Key Objective

The intricate tax filing system in India poses challenges for both businesses and individuals, often leading to extensive time commitments. For example:

- Individuals: Filing individual returns can take from several hours to multiple days.

- Small Businesses: For companies with a turnover under ₹1 crore, the filing process often takes about a week.

- Mid-sized Enterprises: Mid-sized businesses, with turnovers between ₹1 crore and ₹5 crore, may take up to 10 days to complete their filings.

- Large Corporations: For larger companies with turnovers above ₹5 crore, returns can take up to a month, with audits extending even longer.

Tax professionals have echoed these concerns, with chartered accountants noting that the complexity of forms and queries often results in a high level of caution during filing. Beyond income tax, the Goods and Services Tax (GST) filing process presents similar obstacles, sometimes stretching over several weeks for comprehensive audits.

Addressing Complexity in the Income Tax System

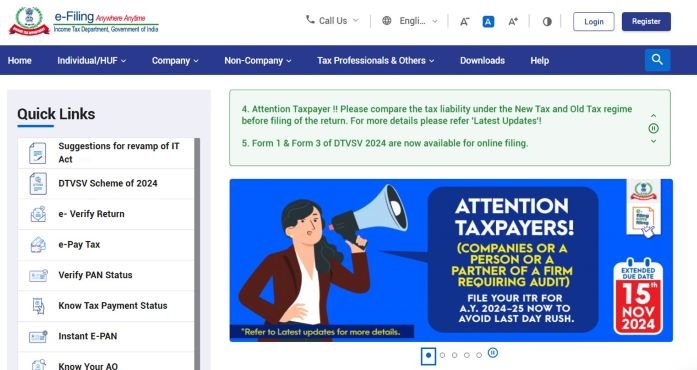

The Finance Ministry is tackling these challenges head-on, with a series of reforms aimed at streamlining procedures and promoting voluntary compliance. To this end, 22 dedicated sub-committees have been convened to evaluate and suggest amendments to the Income Tax Act. Among their goals is to simplify tax forms, reduce the volume of required paperwork, and improve digital infrastructure to support an efficient e-filing system.

Since the introduction of faceless assessments in April 2021, which minimizes human involvement in tax disputes, the government has made substantial strides in easing the compliance process. This initiative, along with ongoing digital advancements, aims to ensure that filing taxes becomes a routine process rather than a complex task for businesses and individuals alike.

Simplifying Tax Brackets and Lowering Rates

A core aspect of the reforms involves a potential reduction in tax brackets and rates. India’s tax structure, with its numerous exemptions and deductions, has often been criticized for being complex and challenging to navigate. In response, the government is exploring ways to consolidate tax brackets and create a more transparent system.

In addition to personal tax reforms, proposals to reduce corporate tax rates are also being considered. This reduction is intended to bolster India’s competitive standing in the global market, fostering a favorable environment for foreign and domestic investment. By easing corporate tax rates, the government hopes to stimulate economic growth, drive industrial expansion, and support job creation across sectors. There is also consideration for providing targeted relief to middle-income groups and small businesses, as these segments have been pivotal in the country’s post-pandemic recovery.

Expanding the Tax Base: A Broader Government Strategy

Prime Minister Narendra Modi has consistently urged citizens to come forward and contribute to the tax system. India’s narrow tax base has historically hindered revenue growth, with many citizens and businesses operating outside the formal tax network. To address this, the Finance Ministry is focusing on expanding the tax base through voluntary compliance and advanced analytics.

Leveraging data analysis tools, the government aims to identify potential tax evaders and encourage broader participation in the formal economy. Moreover, promoting digital transactions and formalizing the informal economy are expected to support this shift. As more businesses and individuals engage with digital platforms, the government anticipates improved transparency and tax compliance across the board, furthering its objective of inclusive financial participation.

Balancing Taxpayer Relief with Revenue Generation

While these reforms are geared towards easing the tax burden on individuals and businesses, the Finance Ministry remains focused on ensuring that government revenue is not compromised. Taxpayer relief measures must be balanced with adequate revenue streams to maintain essential investments in infrastructure, healthcare, and social welfare.

The proposed reforms, from simplifying tax filing processes to expanding the tax base, underscore the government’s dual objective of fostering economic growth while safeguarding public services. As Budget 2025-26 unfolds, taxpayers and businesses alike will be closely watching for changes that could reshape India’s financial landscape, making it more accessible, efficient, and equitable.

Also See:

Jharkhand Phase 1 Assembly Polls Conclude

Vivek Ramaswamy’s Graduation Speech from 2003 Goes Viral

——————————————————————————-

It would mean the world to us if you follow us on Twitter, Instagram and Facebook. At Newscazt, we strive to bring you the latest news and stories from India, World, Business, Sports, Entertainment and more. Our team of experienced journalists and writers are committed to delivering accurate and unbiased news and analysis.