New Deadline Announced for Aadhaar-PAN Linking

The Central Board of Direct Taxes (CBDT) has extended the deadline for taxpayers to link their Permanent Account Number (PAN) with their Aadhaar to June 30, 2023. Linking PAN with Aadhaar is considered a crucial measure to combat tax evasion, according to officials. If taxpayers do not link the two documents, their PAN card will become inoperative, rendering them unable to furnish, intimate, or quote their PAN.

Consequences of Not Linking Aadhaar and PAN

Beginning July 1, the CBDT has outlined penalties that taxpayers will face if their Aadhaar and PAN are not linked:

- No tax refunds will be granted for such PAN cards

- If taxpayers link the two documents after filing their return, the Income Tax department will not pay interest on the refund for the period when the two documents were not linked

- Both tax deducted at source (TDS) and tax collected at source (TCS) will be deducted/collected at higher rates in such cases

- Taxpayers can reactivate their PAN card within 30 days after paying a ₹1,000 late fee

How to Check Aadhaar-PAN Link Status: Step-by-Step Guide

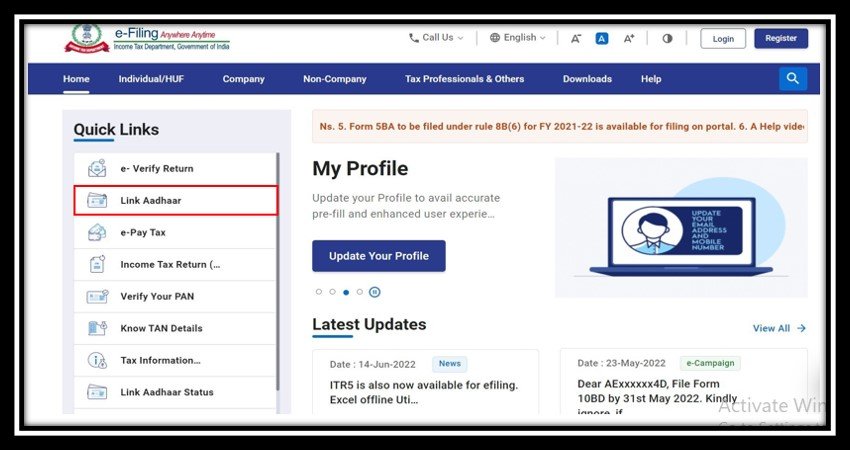

To verify the status of Aadhaar-PAN linking, taxpayers must visit the Income Tax e-filing portal:

- On the homepage, click on “Quick Links,” then “Link Aadhaar Status”

- The following page will have two fields where taxpayers must enter their PAN and Aadhaar numbers

- After the server verifies the status, a pop-up message will appear. If Aadhaar and PAN are linked, the message will read: “Your PAN is already linked to the given Aadhaar”

- If the two documents are not linked, the following message will be displayed: “PAN not linked with Aadhaar. Please click on ‘Link Aadhaar’ to link your Aadhaar with PAN”

- If the Aadhaar-PAN link is pending, the taxpayer will see this message: “Your Aadhaar-PAN linking request has been sent to UIDAI for validation. Please check the status later by clicking on ‘Link Aadhaar Status’ link on Home Page”

Taxpayers can also check the status by logging into the Income Tax portal and completing these steps:

- After logging in, visit the “Dashboard” on the homepage and click the “Link Aadhaar Status” option

- Alternatively, go to “My Profile” and click on the “Link Aadhaar Status” option

- If your Aadhaar is linked to the PAN, the Aadhaar number will be displayed. If the two documents are not linked, “Link Aadhaar Status” will be displayed

- The website will also show a check-the-status later option if the request to link your Aadhaar with the PAN card is pending with the Unique Identification Authority of India (UIDAI)

As of now, the CBDT has reported that 51 crore PAN cards have been linked with Aadhaar.

——————————————————————————-

It would mean the world to us if you follow us on Twitter, Instagram and Facebook.

At Newscazt, we strive to bring you the latest news and stories from India, World, Business, Sports, Entertainment and more. Our team of experienced journalists and writers are committed to delivering accurate and unbiased news and analysis.