India Crosses $1 Trillion FDI Milestone Since 2000

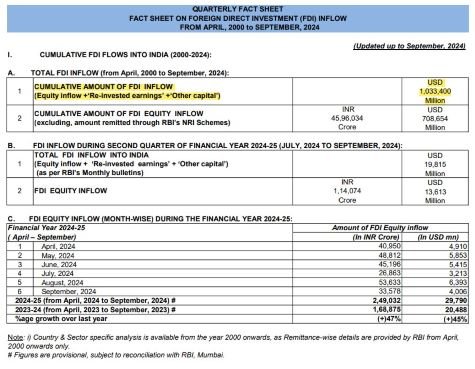

India has reached a historic milestone in its journey as a global investment hub, with Foreign Direct Investment (FDI) inflows crossing the $1 trillion mark since the turn of the century. According to data released by the Department for Promotion of Industry and Internal Trade (DPIIT), the cumulative FDI inflows—including equity, reinvested earnings, and other capital—stood at $1,033.40 billion between April 2000 and September 2024.

India’s FDI Journey Hits $1 Trillion

First half of FY 2024-25 sees a 26% increase to $42.1 billion

🔹 FDI has played a transformative role in India’s development by providing substantial non-debt financial resources, fostering technology transfers, and creating employment… pic.twitter.com/96HAccAaDP

— PIB India (@PIB_India) December 12, 2024

FDI Sources: Mauritius and Singapore Lead

While the United States and China might seem like obvious contributors to India’s FDI, Mauritius and Singapore have emerged as the largest investors. Mauritius accounted for 25% of total FDI inflows during this period, closely followed by Singapore at 24%.

The United States came in third with 10%, with other notable contributors including The Netherlands (7%), Japan (6%), and the United Kingdom (5%). Smaller but significant investments came from the UAE (3%) and territories such as the Cayman Islands, Germany, and Cyprus, each contributing 2%.

Key Sectors Attracting Investment

The services and allied sectors received the highest share of FDI, with significant inflows into:

- Computer software and hardware

- Telecommunications

- Trading

- Construction and infrastructure

- Automobiles

- Chemicals

- Pharmaceuticals

The government’s liberalized policies and initiatives like Make in India have made these sectors attractive for foreign investors.

Recent Decade Sees Accelerated Growth

Of the $1.033 trillion in total FDI inflows, $667.4 billion (approximately 65%) came in the last decade (2014–2024), representing a 119% increase compared to the previous ten years.

The manufacturing sector, a key focus of the Make in India initiative, saw a 69% rise in FDI inflows during this period. With FDI flowing into nearly 60 sectors across 31 states and union territories, India’s diversified economy has solidified its position as a global investment destination.

FDI Policies

India’s FDI policies have evolved to attract more investments. Most sectors allow 100% FDI under the automatic route, while certain strategic areas like telecommunications, media, insurance, and pharmaceuticals require government approval.

Under the automatic route, foreign investors only need to notify the Reserve Bank of India (RBI) after making the investment. For sectors requiring approval, investors must seek prior clearance from the relevant ministry or department.

However, FDI remains prohibited in areas like:

- Lottery, gambling, and betting

- Chit funds

- Nidhi companies

- Real estate businesses

- Manufacturing of tobacco products

To put the $1 trillion figure into perspective, India’s 2024 GDP stands at $3.89 trillion, more than double the $2 trillion GDP in 2014. Comparatively, achieving a trillion dollars in FDI highlights India’s growing economic prominence and its appeal to global investors.

India’s achievement of $1 trillion in FDI reflects its transformation into a preferred investment destination, supported by liberalized policies, diverse opportunities, and robust economic growth. As India continues to focus on infrastructure, technology, and manufacturing, the inflow of foreign investments is expected to grow, further solidifying its position as a key player in the global economy.

See Also:

Pushpa 2 Creates Box Office History

Ousted Syrian President Assad Granted Asylum in Russia

Bank Manager Assaulted Over Fixed Deposit Tax Deduction

Delhi Influencer’s Bizarre Green Chilli Lip Plumping Hack

——————————————————————————-

It would mean the world to us if you follow us on Twitter, Instagram and Facebook. At Newscazt, we strive to bring you the latest news and stories from India, World, Business, Sports, Entertainment and more. Our team of experienced journalists and writers are committed to delivering accurate and unbiased news and analysis.