Tax Debate Intensifies as Budget Day Approaches

As India gears up for Budget Day, the ongoing debate over the middle class’s disproportionate tax burden has gained renewed focus. With a small pool of taxpayers contributing significantly to government revenue, there is growing demand for relief measures, particularly for the salaried class.

Over the past decade, the number of individual tax filers has more than doubled, from 3.35 crore in 2013-14 to 7.54 crore in 2023-24. However, a substantial number of these returns reflect zero tax liability, indicating compliance rather than contribution. The number of individuals filing zero-tax returns has also more than doubled during this period, from 1.69 crore to 4.73 crore. Meanwhile, the number of taxpayers paying income tax has increased from 1.66 crore to 2.81 crore.

Shift in Corporate and Personal Tax Ratios

A key factor in this debate is the shift in tax revenue composition following corporate tax reforms. In September 2019, the government slashed the base corporate tax rate for existing companies from 30% to 22% and for new manufacturing firms incorporated after October 1, 2019, to 15% from 25%. This move led to a noticeable shift in tax collections.

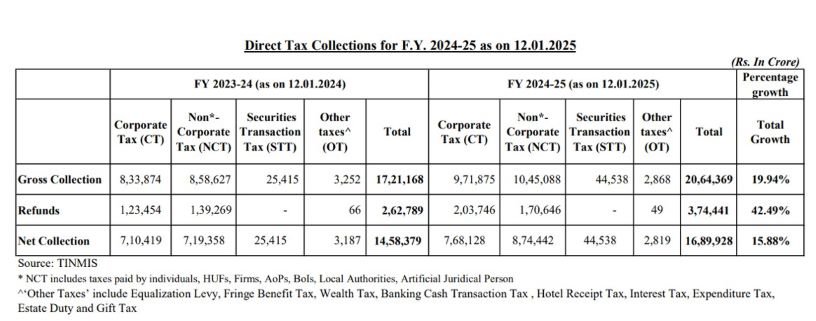

From 2020-21 to 2024-25, the ratio of personal income tax (PIT) to corporate income tax (CIT) collections rose from 0.7x to 1.1x. While corporate income tax revenue grew by 83%, from ₹5.56 lakh crore in 2019-20 to ₹10.2 lakh crore in 2024-25, personal income tax revenue surged by 141%, from ₹4.92 lakh crore to ₹11.87 lakh crore over the same period.

The GST Burden on Individuals

Annual Goods and Services Tax (GST) collections in India range between ₹18 lakh crore and ₹20 lakh crore. While the government does not disclose the proportion of GST collected from individuals versus corporations, input tax credit claims suggest that a significant portion is borne by individuals. Businesses can offset GST paid on goods or services used for business purposes, shifting much of the GST burden to consumers.

In 2023, five states accounted for over half of India’s total GST collections. Maharashtra led with 21.2%, followed by Karnataka (9.3%), Gujarat (8.4%), Tamil Nadu (8.2%), and Uttar Pradesh (6.8%). These states, except Uttar Pradesh, are more urbanised than the national average of 31.1%, underscoring the higher GST contributions from urban middle-class areas.

Urban Middle Class

Urbanisation and economic activity concentrate tax contributions in cities, where a significant portion of India’s middle class resides. The combined impact of direct taxes, such as PIT, and indirect taxes like GST underscores the financial pressures on this demographic.

A Call for Equitable Reforms

As the government prepares to present the Union Budget, taxpayers are hopeful for measures that will address these disparities. The salaried middle class, which forms the backbone of India’s tax revenue, seeks tangible relief through increased exemptions, streamlined processes, and measures to ease indirect tax burdens.

Also see:

Auspicious Amrit Snan at Maha Kumbh 2025

Blue Origin New Glenn Rocket Launch Delayed

China Considers TikTok US Sale to Elon Musk

Maha Kumbh Mela 2025: A Historic Convergence of Devotion and Tradition

—————————————————————

It would mean the world to us if you follow us on Twitter, Instagram and Facebook.